When the power goes out, the silence can be deafening, but the frustration often speaks volumes. For many homeowners, a reliable standby generator isn't just a luxury; it's a necessity, ensuring everything from essential medical equipment to the food in your freezer keeps running smoothly. But the upfront investment can be significant, leading many to wonder about Financing Options and Incentives for Standby Generator Installation. Thankfully, backing up your home doesn't have to drain your savings account all at once.

This guide will walk you through the various ways to make a whole-home generator an affordable reality, exploring everything from dedicated dealer programs to specialized loans and general financing avenues. We'll demystify the process, helping you find a solution that fits your budget and brings peace of mind.

At a Glance: Your Standby Generator Financing Options

- Dealer-Specific Programs: Brands like Generac offer financing directly through partners like Synchrony, often featuring promotional rates or long-term fixed APRs.

- Specialized Home Improvement Loans: Providers like PowerPay offer quick approval, competitive rates, and can cover the full cost of equipment, labor, and installation.

- General Credit Solutions: Personal loans, home equity lines of credit (HELOCs), and even credit cards can be viable, depending on your financial situation and the project size.

- Investment, Not Just an Expense: A generator is a smart investment, protecting your home and family during outages and potentially increasing property value.

- Flexible Terms: Loan durations can range from a few months to over a decade, allowing you to tailor payments to your budget.

Why a Standby Generator is More Than Just a Convenience

Before we dive into how to pay for one, let’s quickly acknowledge why so many homeowners are choosing to invest in a standby generator. From extreme weather events like hurricanes and blizzards to an aging power grid, outages are becoming more frequent and unpredictable. A permanently installed standby generator detects a power loss automatically, kicks on within seconds, and can power your entire home until utility service is restored.

It’s about more than just keeping the lights on; it’s about safety, security, and maintaining essential functions. Think about critical medical devices, sump pumps protecting your basement, or simply keeping your family warm in winter or cool in summer. This isn't a small appliance; it's a robust system designed for serious resilience.

Understanding the Investment: What Does a Standby Generator Cost?

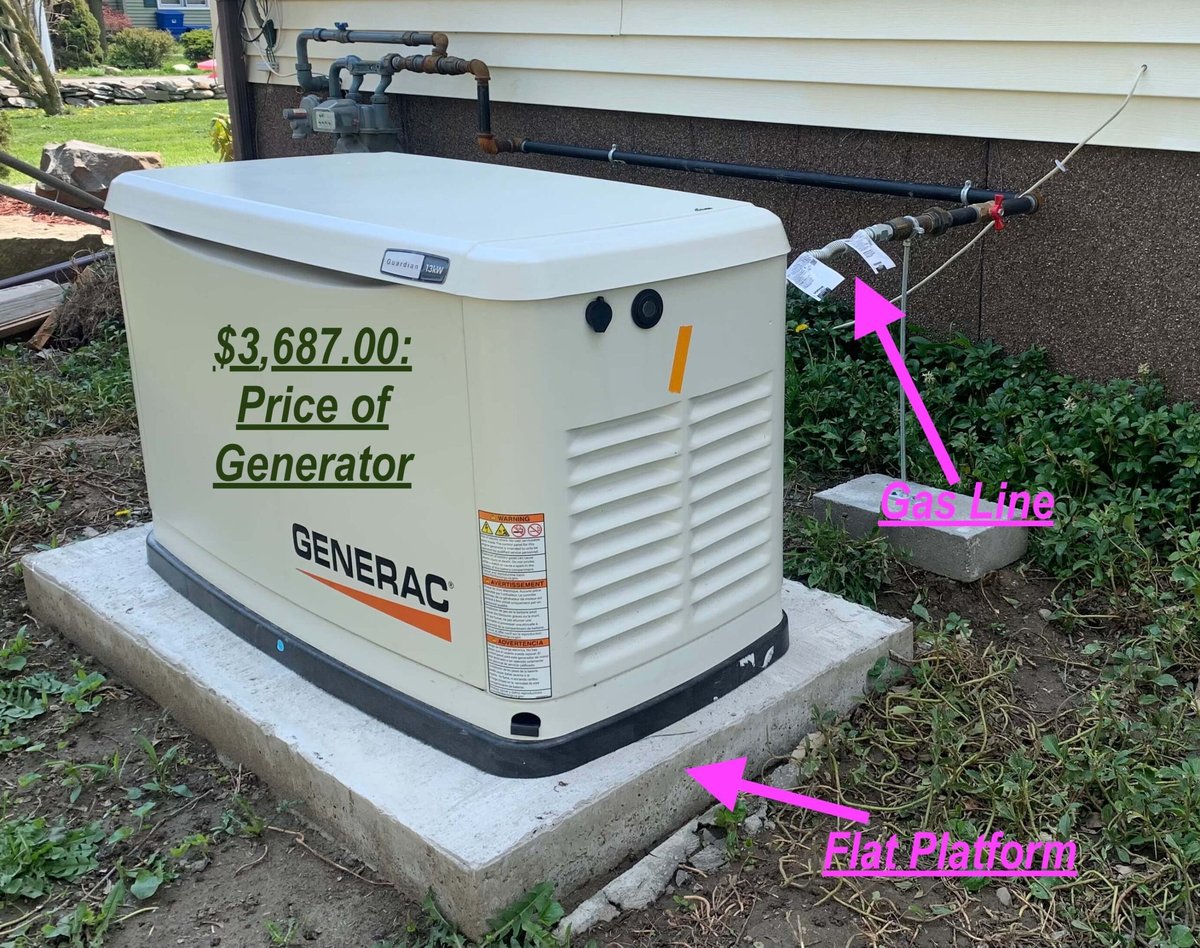

The price tag for a whole-home standby generator can vary significantly, typically ranging from $2,500 to $12,000 for the unit itself. On top of that, professional installation, which is almost always required for standby units, can add another $800 to $2,000. This brings the average total cost for a quality whole-home system to around $4,000, though it can easily climb to $10,000 or more depending on various factors.

Key Cost Influencers:

- Wattage (Size): Larger homes or those with more power demands will require a higher wattage generator, which costs more.

- Brand and Model: Premium brands or models with advanced features (like Wi-Fi monitoring or quiet operation) will command a higher price.

- Fuel Type: Generators run on natural gas, propane, or diesel. The choice can impact the unit cost and installation requirements.

- Installation Complexity: Factors like the distance from your fuel source, electrical panel, and local permitting can all affect the generator installation costs.

- Features: Automatic start/stop, voltage regulation, and advanced control panels add to the unit's price.

While portable generators are an option (typically $500–$2,000) for powering only a few essential items, they require manual setup, fueling, and often an extension cord jungle. For true whole-home peace of mind, a standby unit is the gold standard, and its cost reflects that robust capability.

Specialized Financing: Programs Designed for Generators

When you’re looking at a substantial home improvement project like a standby generator, specialized financing options often offer the most favorable terms. These programs are tailored to the specific needs of homeowners making larger purchases.

Generac's Financing Plans through Synchrony

As a leading manufacturer, Generac understands the investment involved in their products. They've partnered with Synchrony, a reputable financial services company, to offer dedicated financing plans specifically for home generators.

How it Works:

- Find a Dealer: Start by locating an authorized Generac dealer in your area that lists "Financing" as an available option.

- Inquire & Apply: The dealer will guide you through the available plans and the application process. This is often a hassle-free experience with fast credit decisions.

- Dedicated Credit Limit: Once approved, you receive a dedicated credit limit for home improvements, specifically for your generator purchase.

Key Benefits of Generac/Synchrony Financing:

- 0% Fraud Liability: Enjoy peace of mind knowing you're protected.

- Convenient Monthly Payments: Designed to fit your budget.

- Promotional Financing: Often includes special offers to make the purchase even more attractive.

Common Generac/Synchrony Financing Options (subject to change): - Long-Term Fixed APR: A common option is 9.99% APR with fixed monthly payments for 132 months (11 years). Your monthly payments will typically equal 1.25% of the highest balance. Note there's usually a $29 account activation fee. This option is excellent for those who want predictable, low monthly payments stretched over a long period.

- Promotional No-Interest Offers: Another popular choice is No interest if paid in full in 18 months. The catch here is crucial: if the balance isn't paid in full by the end of the 18-month period, interest will be charged from the original purchase date. Monthly payments usually equal 2.5% of the highest balance, plus a $29 account activation fee. This is ideal if you plan to pay off the generator quickly but want the flexibility of monthly payments without immediate interest.

- Special Options Without Credit Score Impact: Generac also offers special financing options that are designed not to impact your credit score during the application process. Always inquire about these specifics with your dealer.

PowerPay: Dedicated Generator Loans

PowerPay is another excellent resource, specializing in unsecured home improvement loans, including those for generators. They aim to make these significant purchases more affordable by streamlining the loan process and offering competitive terms.

What PowerPay Offers:

- Covers Everything: Their loans cover materials, installation, and labor—the complete cost of getting your generator up and running.

- Instant Approval: You can apply online and receive approval in seconds, often for up to $100,000 for home improvements.

- No Hidden Fees: They pride themselves on having no hidden contractor fees, no credit cards involved, and no prepayment penalties if you decide to pay off your loan early.

- Manufacturer Agnostic: You can finance any house or mobile generator from any manufacturer, giving you complete flexibility in your choice of equipment.

- Fixed Rates & Flexible Payoff: Enjoy predictable monthly payments with fixed rates and various repayment plans to suit your budget.

Key Benefits of PowerPay Generator Financing: - Spread Costs: Turn a large upfront expense into manageable monthly payments over months or even years.

- Low Monthly Payments & APRs: Designed to be affordable.

- Long-Term Repayment Plans: Offers flexibility for larger investments.

- Soft Credit Pulls: Applying with PowerPay involves a soft credit pull, which means it won't impact your credit score initially. This is a significant advantage when exploring your options.

How to Apply for PowerPay Financing:

- Apply Online: Visit the PowerPay website and complete their online application. Approval is often instantaneous.

- Provide Basic Info: You'll need to supply some personal details and information about your generator purchase.

- Receive Options: An email will arrive quickly with your loan options and limits. You might even be approved for an amount exceeding your project cost, offering flexibility for potential future maintenance or monitoring services.

- Direct Payout: Once approved, the full lump sum is provided directly to your generator dealer or electrician, ensuring they get paid efficiently.

Need a Contractor? PowerPay can also coordinate you with a participating contractor if you don't already have one. If your preferred contractor isn't partnered with PowerPay, they can typically enroll within 48 hours to facilitate your loan.

General Financing Avenues: Beyond the Specialists

While dedicated generator programs and specialized loans offer clear advantages, other general financing options might also be suitable, especially if you have existing credit lines or specific financial goals.

1. Personal Loans

A personal loan is an unsecured loan (meaning no collateral is required) that you can use for almost any purpose, including home improvements.

Pros:

- Fixed Interest Rates: Predictable monthly payments.

- Fixed Repayment Terms: You know exactly when the loan will be paid off.

- No Collateral: Your home isn't at risk if you default.

- Quick Funding: Often approved and funded within a few business days.

Cons: - Higher Interest Rates: Compared to secured loans like HELOCs, personal loan interest rates can be higher, especially if your credit score isn't top-tier.

- Credit Dependent: Approval and interest rates heavily rely on your credit history and score.

2. Home Equity Line of Credit (HELOC) or Home Equity Loan

If you have significant equity built up in your home, a HELOC or home equity loan can be an attractive option due to their lower interest rates.

HELOC (Line of Credit):

- Pros: Functions like a credit card, allowing you to borrow only what you need, when you need it, up to a certain limit. Interest is only paid on the amount you've drawn.

- Cons: Variable interest rates can make monthly payments unpredictable. Your home serves as collateral, meaning it's at risk if you can't make payments.

Home Equity Loan (Second Mortgage): - Pros: You receive a lump sum upfront with a fixed interest rate and predictable monthly payments. Typically lower interest rates than personal loans.

- Cons: Your home is collateral. You commit to borrowing the full amount upfront, even if you don't need it all immediately.

Both HELOCs and home equity loans require an appraisal of your home and can involve closing costs, similar to a first mortgage.

3. Credit Cards

For smaller generator purchases, or if you plan to pay off the balance quickly, a credit card, especially one with a promotional 0% APR period, could be an option.

Pros:

- Convenience: Easy to use, especially if you already have a card.

- Rewards: Some cards offer cashback or travel points.

- 0% APR Offers: If you can pay off the entire balance before the promotional period ends, you pay no interest.

Cons: - High Interest Rates: If you don't pay off the balance during a 0% APR period, the standard interest rates can be very high, making the generator much more expensive in the long run.

- Credit Limit: Your existing credit limit might not be high enough for the entire cost of a standby generator and installation.

- Impact on Credit Utilization: A large purchase can significantly increase your credit utilization, potentially lowering your credit score.

Incentives and Rebates: Lowering Your Out-of-Pocket Costs

While direct cash incentives specifically for standby generators are less common than for renewable energy systems, it's always worth investigating potential savings.

- Local Utility Company Programs: Some utility companies, especially in areas prone to outages, might offer rebates or incentives for installing backup power solutions. Check your local provider's website.

- Insurance Discounts: Inquire with your home insurance provider. Having a standby generator that prevents damage (like a burst pipe from a frozen home or spoiled food) during an outage might qualify you for a slight discount on your premiums.

- Energy Efficiency Programs: Though primarily aimed at efficiency, some broader home improvement programs might offer general support that could apply if your generator contributes to an overall energy strategy (e.g., peak demand reduction).

- Tax Credits/Deductions: While currently no federal tax credits directly target standby generators for residential use, tax laws can change. Consult with a tax professional to see if any local, state, or federal programs could apply to your specific situation.

Always ask your generator dealer or installer about any local incentives they might be aware of. They often have the most up-to-date information on regional programs.

Choosing the Right Financing Option: What to Consider

With multiple options on the table, how do you decide what's best for your standby generator project? Here are key questions to ask yourself:

- What's Your Credit Score? This will significantly impact the interest rates and terms you qualify for. Higher scores generally unlock better deals.

- How Quickly Do You Want to Pay it Off? If you can pay within 12-18 months, a 0% APR promotional offer might be ideal. If you need more time, a longer-term fixed-rate loan is better.

- What's Your Monthly Budget? Longer repayment terms mean lower monthly payments, but you'll pay more interest over the life of the loan. Shorter terms mean higher payments but less overall interest.

- Are You Comfortable Using Your Home as Collateral? If not, unsecured options like personal loans or dealer financing are preferable.

- Do You Value Simplicity or Flexibility? Dealer programs are often straightforward. PowerPay offers flexibility across manufacturers. HELOCs offer ongoing access to funds.

- What Are the Total Costs? Always look beyond the monthly payment to the total amount you'll pay over the life of the loan, including any fees (origination, activation, prepayment penalties).

Is a Home Generator a Good Investment? Absolutely.

Beyond the immediate peace of mind, a home generator is indeed a sound investment. It provides critical backup power during outages, protects against natural disasters, and ensures you're prepared for emergencies. For those running essential home-based businesses or with family members requiring constant power for medical reasons, it's indispensable.

Furthermore, a permanently installed standby generator can add value to your home. In a competitive housing market, prospective buyers often see a whole-home generator as a significant upgrade, offering convenience and safety that sets your property apart. While estimates vary, you can often recoup a substantial portion of the installation cost at resale.

Common Questions About Generator Financing

- Can I finance a generator for a long time? Yes, financing durations can be quite flexible. Some loan terms extend up to 20 years, allowing for very low monthly payments.

- Will financing impact my credit score? Applying for new credit typically involves a hard inquiry, which can temporarily ding your score. However, many specialized providers like PowerPay offer pre-qualification with a soft credit pull, which has no impact. Always confirm the type of credit check before applying.

- Are there prepayment penalties? Some loans, especially personal loans or specific dealer programs, might have prepayment penalties if you pay off the loan early. Always read the fine print. PowerPay specifically states they have no prepayment penalties.

- Can I include installation costs in the financing? Yes, most generator-specific financing programs and home improvement loans (like PowerPay) are designed to cover the entire project, including materials, labor, and installation.

Your Next Step: Get Informed, Get Quotes, Get Prepared

Securing your home with a standby generator is a wise decision, and financing it doesn't have to be complicated. Start by evaluating your needs, understanding the typical costs associated with generator installation, and then exploring the financing options available to you.

Reach out to authorized dealers in your area for quotes, and ask them directly about their financing partnerships, like those with Synchrony. Simultaneously, explore options from specialized lenders like PowerPay to compare rates and terms. By comparing offers and understanding the fine print, you can confidently choose a financing solution that makes your home's backup power a manageable and smart investment. Don't wait until the next outage to realize the value of preparedness; take action today and secure your family's comfort and safety.